Independence can be a lonely road, but you don't have to walk it alone.

Join Us!Join us and discover a new standard for independent advisors.

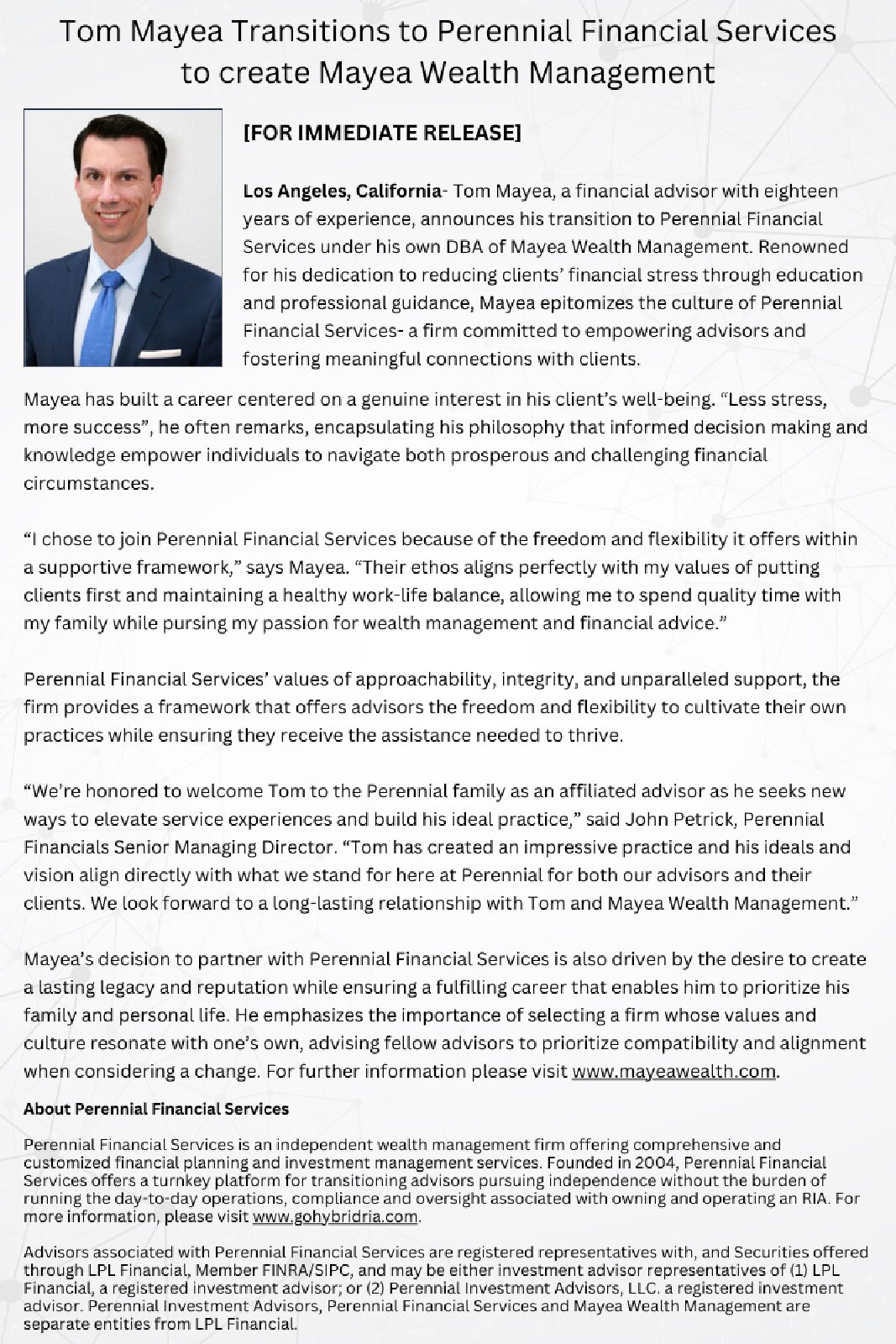

When you join our team, you become part of a community where your talents are commended, your efforts are recognized, and your ambitions are supported. If you’re feeling like your voice is being drowned out in the noise of corporate structures, wirehouses, or banks, we understand. That’s why we’re here to offer you a solution- a place where you can truly be heard, appreciated, and empowered.

Get the Support You Deserve.

We understand that the financial advisory landscape can feel restrictive at times, stifling your creativity and autonomy. By joining Perennial Financial Services, you’ll experience a refreshing change. Here, you’re not just another advisor- you’re a vital part of our community, with the support and resources you need to thrive.

Chart Your Own Path to Success

LPL Independent

Envision the ability to shape your own journey and contrast the perfect business tailored to your aspirations. Picture the liberty to serve your clients on your terms, determine the support level that suits you best, and retain a greater portion of your earnings.

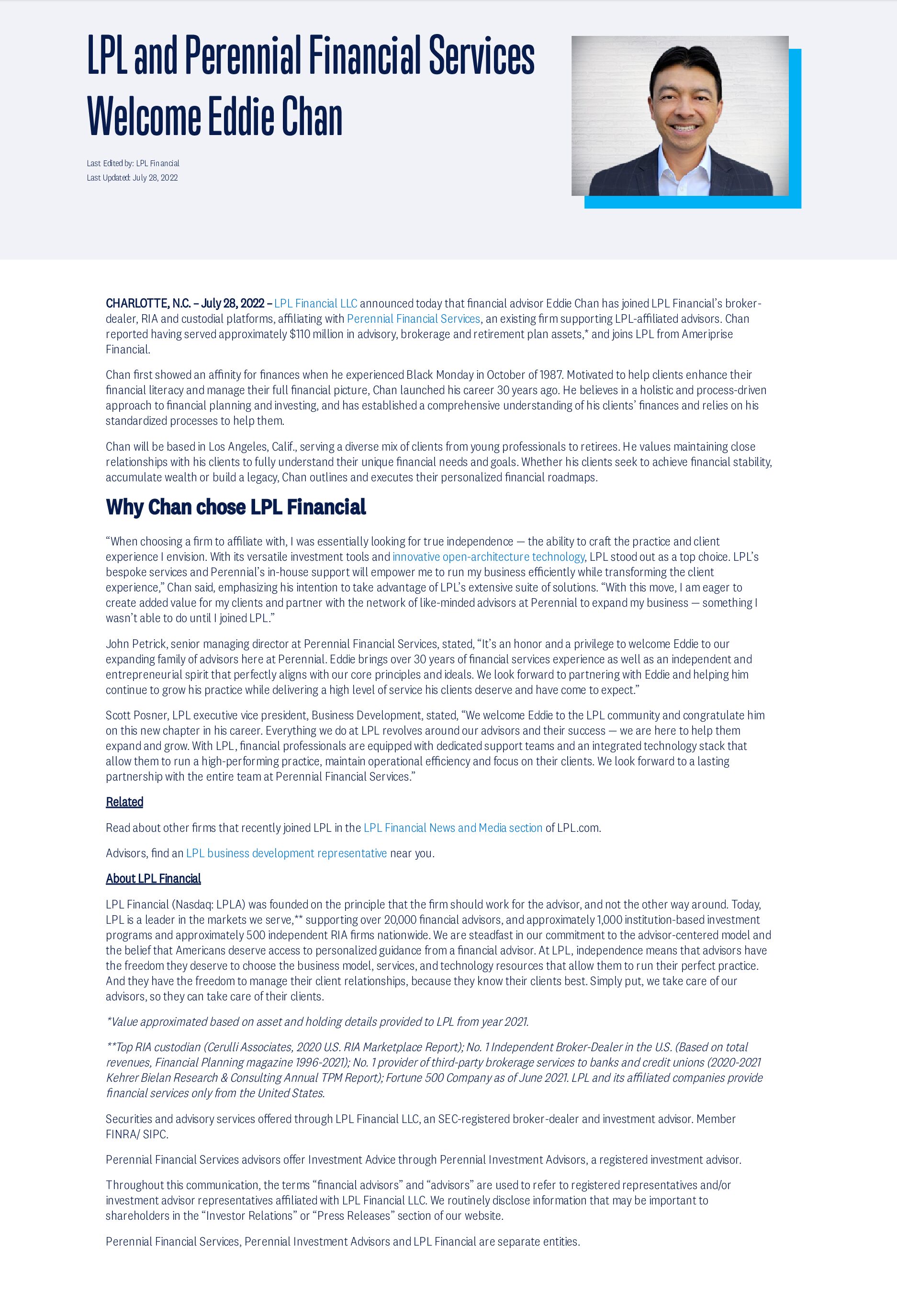

Being independent under Perennial Financial Services, you have access to a diverse range of resources, spanning advanced technology, comprehensive research, compliance assistance, and practice management tools all while being affiliated with and supported by LPL Financial, the nations largest Broker/Dealer*.

We offer opportunities for business expansion, whether through diversifying services, attracting new clients, or exploring additional revenue streams. Advisors have the resources, support, and community they need to flourish and realize their business objectives.

*As reported by Financial Planning magazine, June 1996-2023, based on total revenue.

Fee Only

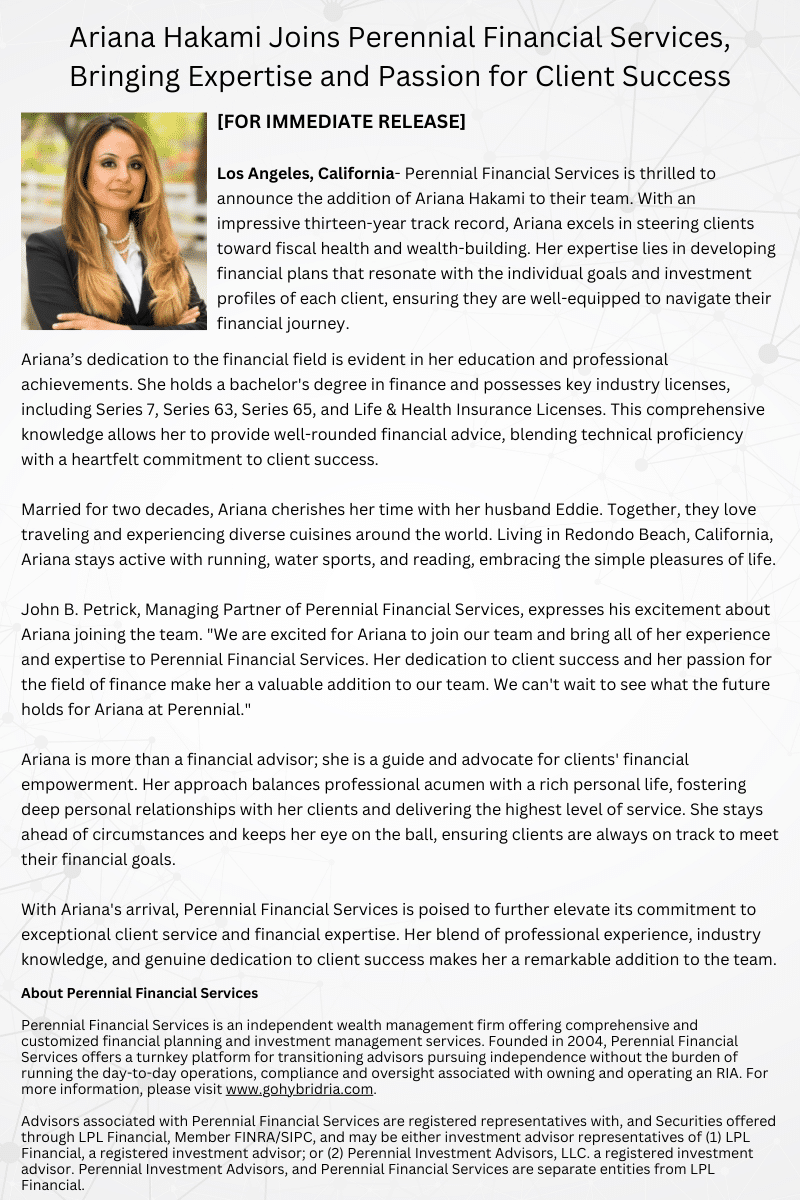

Fee-only advisors are committed to acting in their clients’ best interests, devoid of any financial incentives to do otherwise. By not relying on commissions from product sales, you can provide independent advice tailored to each of your client’s financial situation and goals.

By being compensated directly by your clients, you reduce conflicts of interest that may arise from a commission-based compensation structure. This alignment ensures that your recommendations are solely focused on what is most beneficial for your client.

While often taking a comprehensive approach to financial planning, this may make you consider other aspects of your client’s financial life, such as retirement planning, risk management, and more, providing your clients with a well-rounded financial strategy.

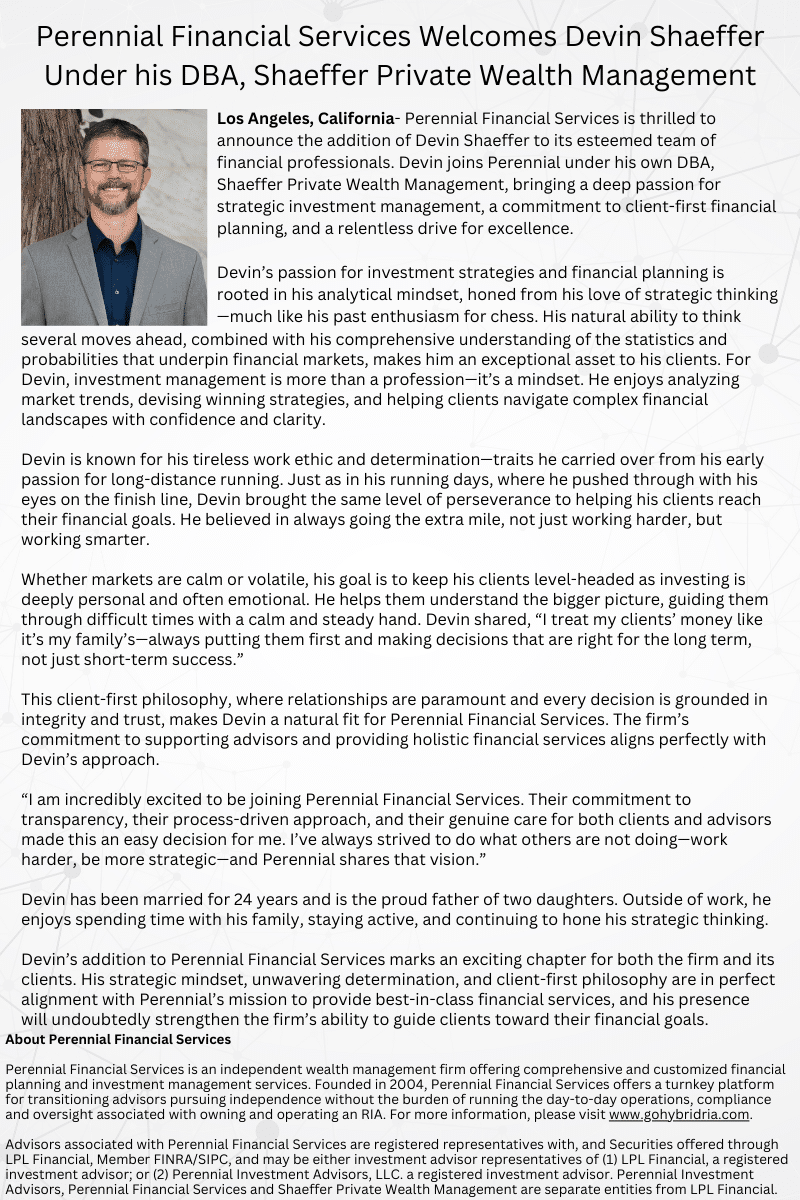

Hybrid

As a hybrid financial advisor, you can provide a broad range of services to your clients, including both commission-based offerings through a Broker/Dealer and fee-based services through a Registered Investment Advisor entity. This flexibility allows you to cater to different client preferences and financial needs.

By embracing a hybrid model, you have the opportunity to expand your skills, knowledge, and expertise across different aspects of financial planning and wealth management. This continual growth not only benefits your clients but also enhances your own professional development.

Being a hybrid financial advisor allows you to offer comprehensive, technology-driven solutions while maintaining a personalized and client-focused approach to financial planning.